- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

- Studentshare

- Subjects

- Miscellaneous

- Pricing basic financial instrument

Pricing basic financial instrument - Essay Example

- Subject: Miscellaneous

- Type: Essay

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: dickinikki

Extract of sample "Pricing basic financial instrument"

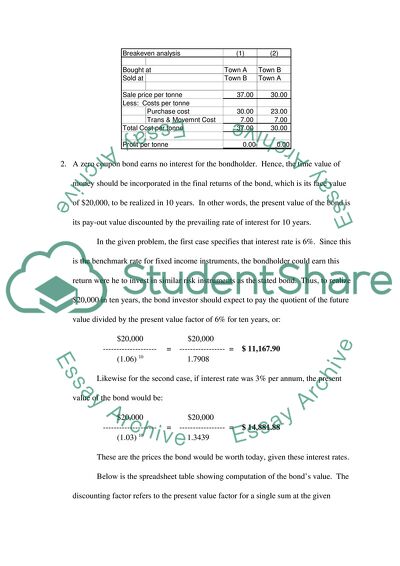

price of cabbages in town B, which is more volatile than that in A, is much less lower or higher than A such as to also cover the costs of transportation and movement, which is identified in the problem as €7 a tonne, then a profit may be made on the difference. 2. A zero coupon bond earns no interest for the bondholder. Hence, the time value of money should be incorporated in the final returns of the bond, which is its face value of $20,000, to be realized in 10 years. In other words, the present value of the bond is its pay-out value discounted by the prevailing rate of interest for 10 years.

In the given problem, the first case specifies that interest rate is 6%. Since this is the benchmark rate for fixed income instruments, the bondholder could earn this return were he to invest in similar risk instruments as the stated bond. Thus, to realize $20,000 in ten years, the bond investor should expect to pay the quotient of the future value divided by the present value factor of 6% for ten years, or: Below is the spreadsheet table showing computation of the bond’s value. The discounting factor refers to the present value factor for a single sum at the given interest rate (6% and 3%) respectively, for 10 years.

The present worth of the stock is obtained by multiplying the discounting factor by the bond’s redemption value after 10 years. 3. The third problem given states that the capital sum is increased by an inflation index and an interest rate of 1% of the indexed capital sum at the end of each year is paid out to the bondholder. The present value of the bond is £100. In order that the buying power of the bond is preserved, the bond value appreciates each year by 2% over the previous year’s capital value.

The interest earned is computed at 1% of the year-end capital sum, as given by the problem. Thus interest paid out during the first year is £1.02, for the second year is £1.04, and for the third year is £1.06. Therefore, the total capital

...Download file to see next pages Read More

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY